The Doty

Windfuels process will be able to make all the fuels and petrochemicals

modern society depends

from renewable energy,

CO

2, and water. As shown in much more detail in a technical

paper we presented at the Spring 2012 National meeting of the

American

Chemical Society, the dominant portion of the capital cost

for a Windfuels plant today would be the electrolyzers – everything

else will be minor, after development. Even with current prices

for electrolyzers and likely off-peak energy wind energy prices,

the Windfuels process can still produce carbon-neutral fuels

for under $2.50/gal. As scale-up of Windfuels drives the demand

for electrolyzers, their prices will steadily drop – probably

to under a quarter of current prices within a decade. The problem

for investors is that there is currently a cheaper way to make

fuels and petrochemicals in high volume – conventional

Gas to Liquids (GTL) processes.

For natural gas at

$5/mcf (its likely price in the U.S. by 2013), the cost of

the methane needed to make

a gallon of diesel by

a conventional GTL process would be $0.88/gal. In a very large

plant, the cost of capital, with 25 year financing, is ~$0.20/gal,

and O&M costs will be similar. The problem for environmentalists

is that there are is enormous CO2 release from the conventional

GTL plant even if the feed is pure methane – and shale

gas typically comes out of the ground containing 12-50% CO2,

which is just vented. So transport fuels via GTL using shale

gas is not environmentally friendly (no matter what the Big

Oil companies say).

Enter CARMA.

We have shown that

by adding some renewable hydrogen in a novel methane reforming

process (called CARMA)

it is possible to reduce

or eliminate the CO2 byproduct from methane reforming, or even

consume CO2 in the process. It depends mostly on the ratio

of renewable hydrogen to methane. The greater this ratio, the “greener” the

fuels produced.

The immediate response

might be, “But

the greater the H2/CH4 ratio, the more expensive the fuels.”

Not necessarily. Adding a small amount of hydrogen allows dramatic

reduction in coking rates and increases in catalyst lifetime

in key portions of the reforming process. It also permits design

of processes with higher efficiency. But the greatest benefit

comes from the flexibility it affords in input choice. The price

of off-peak energy grid energy can easily go from $20/MWhr to

sharply negative, and the price of natural gas can change by

a factor of three in several years. The CARMA process allows

the plant to operate at maximum efficiency over an extremely

wide range of input mixes as the markets change.

Over 90% of the input energy could initially come from shale

gas, while eventually the input energy could come totally from

renewable hydrogen. The amount of CO2 required by the CARMA process

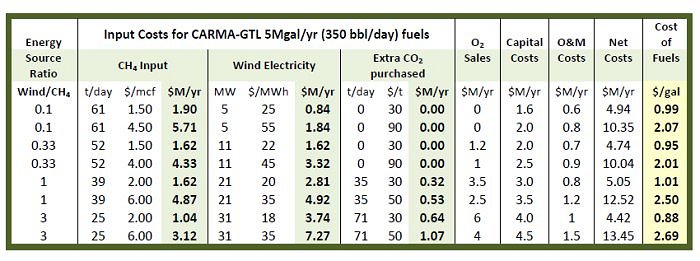

increases with the H2/CH4 feed ratio. The table below summarizes

costs for several CARMA-GTL scenarios in small commercial plants

producing 5 Mgal/yr of fuels. These numbers come from complete

plant simulations using advanced process software (Design-II

by WinSim) and reaction software (HSC7). The numbers have been

validated by experiments and other software.

When the ratio of wind input energy to methane input energy

exceeds ~0.5, the capital costs are dominated by the electrolyzer

costs, for which we assume (extrapolating from the past decade)

a cost of $0.7/W in 2015. The electrolyzer also produces oxygen,

some of which is needed for the CARMA process. When the ratio

of wind energy to methane energy is above ~0.15, there is excess

oxygen, when can be sold. In the table below, revenue from excess

oxygen production is used to offset cost of inputs before calculating

net costs. In all cases, water usage is insignificant in cost

and quantity. Capital costs below assume the 3rd 5-Mgal/yr commercial

plant, interest rate of 5%, and 25-year financing.

As seen in the above table, fuels will be produced from a small

plant at costs ranging from $0.88-2.50/gal, and usually nearer

the low end of this range. Profit from the 5 Mgal/yr plant could

easily exceed $10M annually. Larger plants will achieve somewhat

higher efficiency, but the primary savings in larger plants will

come from reduced capital costs.

Preliminary laboratory

experiments have validated crucial questions with respect to

kinetics and catalyst performance – lifetime,

activity, and selectivity. The detailed plant simulations

show that the FTS gas-to-liquids processes can be scaled down

with

competitive cost and efficiency, achieving ~50% efficiency

in a 5 Mgal/yr plant and ~65% efficiency at 30 Mgal/yr.

CARMA is distinguished

from most alternatives in that it will be rapidly scalable

and immediately competitive

with relatively

little R&D. Adequate low-cost catalysts are commercially

available, though improved performance will be possible with

our novel, proprietary catalysts. CARMA will function as

a near-term bridging solution to the ultimate Windfuels process,

which will

use no methane. Our experiments have confirmed that the Reverse

Water Gas Shift (RWGS) reaction will permit the reduction

of CO2 to CO at efficiency approaching theoretical limits

in inexpensive

reactors. A proprietary low-cost catalyst we recently tested

achieved near theoretical CO2 conversion at rates 50 times

higher than seen in most prior RWGS experiments.

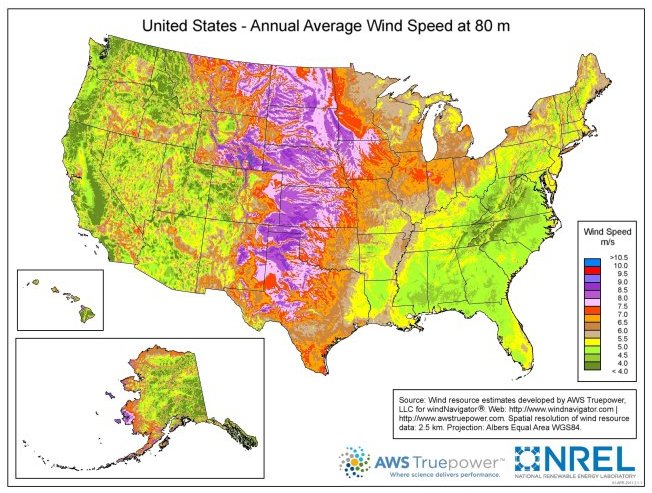

The domestic off-peak wind and point-source CO2 resources are

sufficient to supply more than the entire current domestic transport

fuel demand of 500 million gallons per day. Each year the US

emits over 4 gigatons of point-source CO2 (from fossil fuel power

plants, ammonia plants, cement factories, etc.) and based on

a recent study by NREL there is potential for over 1800 GW of

off-peak wind power just in the U.S. wind corridor. The only

significant scalability hurdle for Windfuels would be the cost

of the electrolyzers during the next decade. As long as natural

gas is cheap, the CARMA process will be more competitive, and

it too is fully scalable. Hence, CARMA technology will be used

in the early plants that will steadily and seamlessly transition

from low-carbon to fully carbon-neutral fuels over the coming

decade as wind hydrogen becomes more competitive. The internal

reactor designs and separation processes are identical between

the two processes, so the transition from CARMA to WindFuels

will involve little more than modularly adding additional electrolyzers

as grid integration needs increase and electrolyzer costs decrease.

Advantages for the novel Windfuels/CARMA-GTL processes include:

1. The synfuels produced are the cheapest alternative.

2. The synfuels do not compete with food or agriculture.

3. The CARMA-GTL fuels are cleaner than GTL synfuels with

very high methane feed percentage, cleaner than all other

fuels – including

biofuels – with as little as 30% renewable hydrogen, and

ultimately they will be fully carbon neutral – totally

from CO2 and renewable H2.

4. The processes are scalable to the level needed to

sustainably meet global transport fuel needs.

5. Windfuels will allow the US to become the world’s largest

exporter of clean fuels – forever.

6. The capital costs for the plants in $/bbl/day will

be similar to that for conventional GTL plants.

7. The CARMA process yields syngas with the needed H2/CO/(CH4+CO2)

ratios over a very wide range of CH4/H2 feed ratios when

appropriate CO2/H2O/O2 co-feed ratios are chosen.

8. The synfuels process is based mostly on demonstrated

commercial technologies.

9. CARMA eliminates the need for expensive very-high-temperature

heating to get the syngas.

10. Windfuels/CARMA-GTL will completely solve the wind

integration problem by drawing electrical power when

excess is available

at low prices.

11. The technology includes a scaling down of conventional

GTL processes to enable fuel production from distributed

methane

and wind sources. It will be efficient and competitive

in plants as small as 2 Mgal/year, with average wind

power input as low

as 1.3 MW.

Traditional thinking assumes very large plants are needed

for FT, largely due to the need for pure oxygen (in the

syngas process)

and due to the complexity of the separations systems. The

processes we have designed eliminate these drawbacks. Low-flow-rate

packed

columns can have performance (split ratios, cost/product,

etc.) similar to those of trayed columns with flow rates

two to three

orders of magnitude larger. These needed columns, phase

separators, and recuperators are not commercially available.

Hence, we are

developing the needed equipment, and it will soon form

the basis of major new product lines from Doty Windfuels.

Simplified Windfuels Economics Calculations.

Inputs and Outputs. The last decade of experience with GTL plants

shows that capital costs are a minor portion (~$0.20/gal) of

the total product cost, even though GTL plants are still being

designed and made individually. Relative capital costs should

be similar in mass-produced Windfuels plants, so clearly the

big economic issues are the costs of the feeds and the value

of the products.

The needed CO2 would initially come from commercial sources – ammonia

and CO2-rich natural gas. Cement factories, fossil power

plants, steel plants, and biofuels refineries are other potential

sources.

The CO2 could be delivered via the rapidly growing CO2 pipeline

network (currently driven mostly by enhanced oil recovery,

EOR). There is a large market for CO2. 300 million tons (Mt)

have been contracted for enhanced oil recovery (EOR), and

the beverage market requires tens of millions of tons/year.

Today,

the price of 99.5% pure CO2 (beverage quality) delivered

through high-pressure pipeline is $30-50/ton, and the CO2

pipeline

network is rapidly expanding.

As regulations to reduce CO2 emissions are implemented, competition

will drive the price down, as the only option other than selling

the CO2 will be to pay to exhaust it or pay to sequester it.

It is possible that the pipeline price of CO2 could drop to zero

if climate change policy becomes very stringent, since the actual

cost to separate and clean CO2 from the exhaust of new power

plants could drop below $25/ton within 8 years. Eventually, the

CO2 might come from the atmosphere, though with current technology

the energy required for separating CO2 from the atmosphere is

about 15 times greater than from point sources.

If the cost of the

input energy is $15/MWh (it has often been available for much

less) and the plant efficiency

is 55%, the

cost of the input energy in synthesized diesel (37.7 kWh/gal)

would be $1/gal. The CO2 (currently ~$40/t for beverage grade)

would add ~$0.4/gal, and the amortized plant capital costs

are expected to be under $0.75/gal (assuming some reduction in

electrolyzer

costs). This brings the gross fuel cost to ~$2.15/gal. The

liquid oxy¬gen co-product could add an income stream of ~$0.9

per gallon of fuel produced, and subsidies for carbon-neutral

fuels

could be ~$1/gal. So a rough initial estimate is that the

plant could sometimes sell fuels for as little as $0.25/gal and

still

break even.

Even with no market for oxygen, no credit for climate benefit

or grid stabilization, buying CO2 at current market prices, and

no utilization of natural gas, Windfuels would usually cost under

$2.20/gal.

Windfuels could

be competitive with oil trading as low as $55/bbl, depending

mostly on (1) the price

of off-peak low-carbon

grid energy, (2) the cost of electrolyzers, (3) the market

for the co-produced liquid oxygen (LOX), and (4) the consideration

available (such as a carbon tax) for climate benefit.

It is important to appreciate that there is sufficient point-source

CO2 potential in the U.S. (over 4 gigatons per year, Gt/yr) and

sufficient wind energy potential (~60 PWh/yr) to synthesize over

twice the current U.S. liquid fuel usage (~0.7 Gt/yr) and supply

twice its other energy needs (~20 TWh/yr).

The FTS process does not produce one specific chemical. Catalysts

and conditions are chosen for a desired product emphasis, and

the various products must then be separated. The mixture of products

(all carbon neutral and of exceptionally high-purity) would normally

include gasoline, jet fuel, diesel, ethanol, methanol, ethylene,

propylene, butanol, propanol, hydrogen, cyclohexane, and many

other hydrocarbons. The ratios depend on the catalysts and reactor

operating conditions (temperature, pressure, H2/CO feed mixture,

and residence time).

The Long-term Big Picture.

Chemical processes, unlike agricultural processes (including

growing and harvesting of algae) are fully compatible with

scale up. To illustrate, the larger demonstrations of photosynthetic

algal oil production to date (after two decades of strong

support) have been at the scale of a few hundred gallons

of fuel per

year, and costs thus far have all exceeded $2000/gal. (Non-photosynthetic

algae have done much better, but they’re just driving

up the price of sugar – like ethanol did to corn. Algae

might soon be making fuels from sugar at a price of $15/gal;

but with any significant scale up, the price of sugar will

go through the roof, and with it the price of the fuels derived

from it, whether made by yeast or algae.)

The US market needs

a supply of 200 Bgal/yr of sustainable, carbon-neutral fuels.

Diverting 40% of U.S. corn production to

ethanol to produce under 5% (on an energy basis) of our transportation

fuel needs has caused the mean global price of corn to roughly

double.

Advocates of cellulosic ethanol (CE) have been saying for the

past decade the US can find 1 gigaton of cheap CE feed stocks

and produce over 25% of our transport fuel needs from such. But

that would be equivalent to over three times the sum of current

domestic hay, energy wood, corn-stover, and municipal solid waste

production. Co-firing of such feed stocks in coal power plants

is seeking twice this amount of new biomass. Co-firing of biomass

in coal power plants has a much greater impact per ton on reducing

CO2 and other harmful emissions than CE production (co-firing

5-15% biomass with coal also has other beneficial effects, on

the nature of the ash produced), and co-firing is more economically

sound. Most available cheap biomass will likely be consumed in

co-firing.

If diverting 40% of

our corn production to ethanol caused its price to double,

diverting 70% of our wood,

hay, and corn-stover

production to energy would be much worse – putting

prices in the range of $200-600/ton, depending on quality,

location,

weather, wildfires, labor wages, and the price of oil. If

cellulosic feedstocks are $500/ton, the price of cellulosic

ethanol will

be $6.50/gal (comparable to gasoline at $9.70/gal). In contrast,

the price of Windfuels will only drop as its production scales

up, as there are no significant resource constraints.

At this point it seems

that an optimistic ultimate projection for CE will be under

1% of U.S. fuel production

(the DOE simply

doesn’t have the budget to build more capacity than

that over the next decade).

More importantly,

the operating margins on the WindFuels

plants will be much better – the cost of the inputs will

be much less per gallon of product, the products will be more

valuable, and there will be no waste to deal with.

In order to satisfy currently passed state renewable energy

standard (RES) mandates, there will need to be an additional

~300 TWh/yr of renewable energy produced in America within the

coming decade. Most of this new renewable generation will come

from wind, as no other source is nearly as competitive in most

regions of the U.S. As additional turbines are installed, curtailment

of wind turbines will increase during off peak demand times unless

additional demand comes online as well. The Windfuels and CARMA-GTL

processes can use that off-peak power, meaning that less energy

is wasted and turbine utilization increases. Curtailment in the

US alone is predicted to be 1.5 TWh (1.5x109 kWh) for 2012.

A challenge with wind

energy has been getting it from good sites to where and when

it is needed. The failure

of grid management

to overcome this challenge is shown in the continual curtailment

of wind power throughout the wind corridor (parts of 16 states

in the central US from Texas up through the Dakotas, with

a lesser branch reaching east to Ohio – purple, red, and

orange on the wind speed map below), which has contributed to

a rapid

slow-down in the wind industry. Both CARMA-GTL and Windfuels

provide rapid response to major changes in grid supply and

demand. Thus, windfuels will allow complete stabilization of

the grid,

even if over 50% of the grid energy comes from wind.

Since WindFuels would solve the grid stability challenges, the

best way to increase low-carbon peak grid capacity will be

to simply put up more wind farms. The extra, off-peak energy

will have a strong market for making carbon-neutral, transportation

fuels.

The primary challenge with pure Windfuels is that the prices

of electrolyzers have not been dropping as rapidly as was projected

by DOE studies. Electrolyzers simply cost too much to allow the

electrolyzer market to grow, which has prevented the identified

economy-of-scale cost reductions to come to pass. The CARMA-GTL

process solves this chicken-and-egg dilemma by reducing electrolyzer

requirements by a factor of five or more. Shale gas will steadily

become more expensive over the coming decade while the cost of

electrolyzers will continue to drop as demand from CARMA-GTL

processes drives the electrolyzer industry and leads to economies

of scale. It will be easy to add more electrolyzers and reduce

gas consumption at the CARMA-GTL plants in response to market

changes.

The competitiveness of the proposed processes and the absence

of resource constraints means that the U.S. could end oil imports

within three decades and at the same time begin building a clean-fuels

export industry of even greater magnitude, which will have enormous

security and economic benefits.

The U.S. is in a unique position of being able to competitively

turn CO2 into fuels at the scale needed to affect the global

fuels markets. No other country is similarly blessed with excess

clean-energy resources, point-sources of CO2, and the requisite

industrial infrastructure. The net positive effect on foreign-trade

balance of a market-driven industry of this magnitude could exceed

one trillion dollars annually by 2040. Such a positive effect

on trade balance could lead to the net creation of 10,000,000

jobs.

The U.S. eventually will likely not compete successfully with

Asia in solar panels, batteries, wind turbines, or EVs, but the

United States can supply most of the world with carbon-neutral

liquid fuels forever.

WindFuels are Forever.

Anthropogenic carbon emissions may soon be a little below what

was expected a few years ago – mostly because of increased

incentives for improved efficiency. However, the positive feedbacks

in the climate (especially from the melting of the Arctic)

could offset this progress.

There is still no evidence that hydrogen will ever work in the

transportation sector. Compared to WindFuels, there is no emissions

advantage and no significant efficiency advantage for hydrogen.

There are only huge cost disadvantages.

The public will slowly begin to appreciate that plug-in electric

vehicles will not have a significant effect on carbon emissions

for at least another three decades and that most biofuels are

only 5% to 20% carbon-neutral. As a result, incentives and support

for fully carbon-neutral WindFuels will steadily increase. Wind

will still be providing most of the energy needed for Windfuels

many decades from now, but an increasing fraction may come from

advanced nuclear reactors and solar as those industries steadily

become more competitive.

We show in our discussion of

Scalability why WindFuels will

not experience the same type of hyperinflation seen over the

past six years in biofuels, tar sands, CTL, nuclear, algae-oil,

wood pellets, and shale-oil.

WindFuels will be over 85%

carbon neutral, and they are completely sustainable. When the

last coal power plants are shut down in

~2090, the needed CO2 could come from biofuels refineries,

cement factories, ammonia production, steel mills, and the atmosphere.

References:

1. GN Doty, FD Doty, LL Holte, D McCree

and S Shevgoor, “Securing

Our Energy Future by Efficiently Recycling CO2 into Transportation

Fuels – and Driving the Off-peak Wind Market”,

Proc. WindPower 2009, #175, Chicago, 2009.

2. The Off-peak Wind Market

3. See http://wilderness.org/files/Oil-Shale-FS-global-warming.pdf .

4. Elizabeth Kolbert, “Unconventional Crude”, Annals

of Ecology, Nov. 12, 2007.

5. FD Doty and S Shevgoor, “Securing our Transportation

Future by Using Off-Peak Wind to Recycle CO2 into

Fuels”,

ES2009-90182, ASME Joint Conferences, San Francisco, 2009. Copyright ©2009

by ASME - used by permission for reference only.

6. FD Doty, “Hydrocarbon and Alcohol Fuels from Variable,

Renewable Energy...“, PCT WO 2008/115933,

7. G. Ramachandran, “Program on Technology Innovation:

Integrated Generation Technology Options”, EPRI, Technical

Update, Nov., 2008.

8. SM Cohen, GT Rochelle, J Fyffe, ME Webber, “The Effect

of Fossil Fuel Prices on Flexible CO2 Capture Operation”,

ES2009-90308, ASME Joint Conferences, San Francisco, 2009.

9. AP Steynberg and ME Dry, eds. Studies in Surface Science and

Catalysis 152, Fischer-Tropsch Technology, Elsevier, 2004.

10. S Phillips, A Aden, J Jechura, and D Dayton, “Thermochemical

Ethanol via Indirect Gasification and Mixed Alcohol Synthesis

of Lignocellulosic Biomass”, NREL/TP-510-41168, 2007.

11. K Harrison, G Martin, T Ramsden, G Saur, “Renewable

Electrolysis Integrated System Development and Testing”,

NREL PDP_17_Harrison, 2009, http://www.hydrogen.energy.gov/pdfs/review09/pdp_17_harrison.pdf .

12. FD Doty, “High-Temperature Dual-source Organic

Rankine Cycle with Gas Separations”, PCT

WO 2009/048479, 2009.

13. FD Doty, “Compact, High-Effectiveness, Gas-to-gas

Compound Recuperator with Liquid Intermediary”,

PCT WO-09082504.

14. See http://www.acorechina.org/uscp/upload/6-11-2009.pdf,

Chinese wind turbine growth.

15. See http://www.rechargenews.com/energy/wind/article180724.ece,

Chinese wind turbine prices.

16. See http://www.renewableenergyworld.com/rea/news/article/2009/06/wind-turbine-prices-move-down-says-new-price-index?cmpid=WNL-Wednesday-July1-2009

2009.

17. See http://www.grist.org/article/concentrated-solar-power-goes-mainstream/ , and http://social.csptoday.com/news/gerc-proposes-tarriff-solar-thermal-power , 2009.

18. K Weissermel, HJ Arpe, Industrial Organic Chemistry, 4th

ed., Wiley, 2003.

19. HR BioPetroleum, http://www.hrbp.com/PDF/Huntley%20&%20Redalje%202006.pdf

20. Eric Wesoff, http://www.greentechmedia.com/articles/algae-biodiesel-its-33-a-gallon-5652.html

2009.

21. M Voith, “Cellulosic Scale-up”, C&EN 87 (17),

pp10-13, Apr 27, 2009.

22. A 600,000 gallon tank was quoted by Brown Minneapolis Tank

Company as costing about $420K, or under $0.02/kWhr for jet fuel.

-