|

Updated

8/22/2012

Stabilizing

the Renewable Grid

The Off-Peak Energy Market

New wind farms are signing PPAs for energy at $50/MWh, where will

you get energy for $15/MWh?

There are numerous points throughout the discussion of WindFuels

where we note an expected price for off-peak carbon neutral energy.

In the economics discussion, the worst-case energy prices that

we project in the near term are $25/MWh, and the average case

is $15/MWh. This price expectation is our most often misunderstood

claim – and therefore the claim that is most often challenged.

Understanding the effect that deep wind power penetration has

on the electricity market is crucial to understanding one of

the most

exciting advantages of the WindFuels system – its ability

to use intermittent renewable energy whenever it is available

at a low price.

The ISO/RTO markets.

Most states within the U.S. have their electrical energy traded

through virtual markets within an Independent System Operator

(ISO) or Regional Transmission Operator (RTO). The energy is

openly bought

and sold within these virtual markets in short blocks, and the

pricing is recorded as Local Marginal Price (LMP) - the amount

a buyer would be willing to pay for one additional MWh of energy

traded within that time frame.

ISO/RTO systems are more favorable than other structures to wind

projects at large, as the larger region of established trade

allows for more transmission of energy, “smoothing” local

variability. The limit to the expansion of wind is based on its

profitability, so wind power typically continues to penetrate until

something limits its continued development. In ISO/RTO markets,

the limiter is often the final price of energy – which causes

power companies to hesitate to sign more Purchase Power Agreements

(PPA’s) for delivered energy.

When we first began investigating the economics of the WindFuels

system, we focused on the Minnesota hub in MISO (an RTO that

includes much of the industrial Northern Midwest). At the time,

Minnesota

was the state that had the greatest penetration of wind, followed

by Iowa and North Dakota. The Minnesota hub sees trades that

cover all of MN, ND, and Northern IA. This then was considered

an ideal

predictor of what an electric market with reasonably high penetration

of wind might look like if grid transmission was adequate. We’ve

continued tracking this hub. For the rest of this discussion, we

will be including data from MISO’s RT trades (wind is typically

traded in the real time or RT market) over the Minnesota hub.

More dramatic information could be shown from ERCOT data, but

in ERCOT

transmission issues dominate difficulties with wind power penetration.

There are no transmission problems for the Minnesota hub.

End-use consumers see little price difference between peak and

off-peak energy, or hour-by hour. End-use customers contract

for a given rate, and they use energy as dictated by need. A

WindFuels

system would differ because it would be available to take its

contracted energy needs at times that are solely within the discretion

of

the energy provider – who is trading over MISO. So most of

the Windfuels plant’s energy needs could be satisfied during

the cheapest hours of energy on any given day, and the energy

provider could benefit from having an easy-to-shed energy load

to help deal

with sudden price spikes.

This would be a huge benefit for the power company, as it

would help draw some of the excess energy off of

the grid, forcing

the prices higher for the rest of the trades. If

the presence of an

extra few percent energy beyond demand is forcing

RT energy trades to be negatively priced for 7-40 hours/week,

then

a power company

could simply contract with a WindFuels plant for

the

excess RT energy at a very low price. On some days they'd

lose

money on

that contract, but more often they'd get far more

for that energy sold

to Windfuels then they would have gotten had they

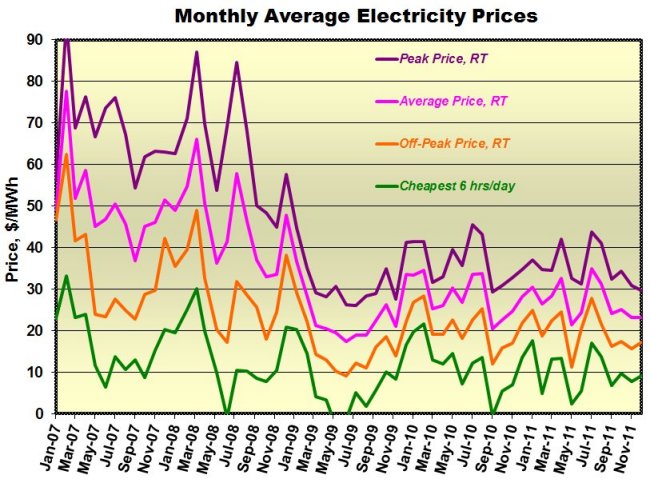

traded it over the ISO (note the “cheapest 6 hours/day” trace in the

above graph – its average recent price is about

$8/MWh). However, there would now be a market every

day with a little

less energy traded RT, which would likely lead to

much stronger RT prices.

Thus they would generate more revenue on the improved

pricing for the rest of the RT sales than they could

ever lose

for the Windfuels

contract.

There is no better way in

an ISO for a power provider to manipulate supply at that level

without substantial

losses – in true

real time. It’s a question of game theory. If a single

power provider tried to manipulate the energy levels through

curtailing

much more of their wind electricity, that provider would lose

100% of the revenue of their curtailed wind, and the curtailment

of

other wind farms would quickly be reduced until the RT price

was back down to about the same level that it had been (price

is causing

these providers to determine when they curtail their wind). So

any provider trying to be more aggressive about wind curtailment

loses more money and advantages their competitors without getting

anything back in return. If instead the excess were simply drawn

off the grid by a controlled variable load, the wind turbines

would see less curtailment and the net prices for the rest of

the energy

traded would either be the same or higher. The power provider

could then gain both in decreased curtailment and in increased

nighttime

prices.

Negative priced energy?

You may (or may not) have heard of the concept of negative priced

energy. But there are times when power companies must literally pay others to take their energy to avoid damage to their assets

and those of their customers on the grid.

Negative pricing occurs whenever electricity providers must reduce

the net energy on the grid but do not expect to require the energy

levels to be reduced for long. Baseload power is slow to ramp up

and down, and sees a highly reduced efficiency if it is quickly

cycled.

Power companies are continually making decisions on the extent

to which their fossil power generation is tamped down versus

selling excess energy to their neighbors at prices that may not

be profitable.

As more and more wind energy is brought online in any region,

preferential treatment of local wind power will ensure that local

markets would

use some of their locally produced wind energy rather than curtailing

it, which means that more energy is now supplied in a market

that hasn’t seen any change in demand. Most grids have less than

10 minutes worth of battery storage capacity, so supply and demand

fundamentals don’t stop affecting prices at production

costs, nor do they stop influencing prices at $0/MWh.

While negative pricing is not new, intermittent wind energy has

caused the instance of negative energy to increase over the past

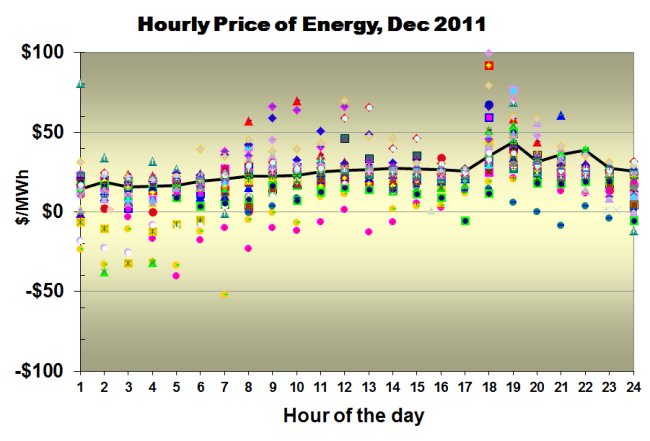

4 years. Figure 2 shows the price of energy at every hour during

the month of December 2011. While the resolution is limited, different

colors were used for days of the week, and different shapes were

used for different weeks of the month. The average hourly price

for the month is traced. (Note these are hourly averages, actual

prices within any given hour can swing wildly from one 5-minute

trading block to the next during a period where wind speed is inconstant).

Figure

2 shows a scatter plot of the trade LMP (local marginal price) over the Minnesota

hub in the real time market of December 2011. While

the average price of energy traded was $23.20/MWh,

it is clear from the trace that the average price for

any individual hour had a large range, and that many

hours were negatively priced. Figure

2 shows a scatter plot of the trade LMP (local marginal price) over the Minnesota

hub in the real time market of December 2011. While

the average price of energy traded was $23.20/MWh,

it is clear from the trace that the average price for

any individual hour had a large range, and that many

hours were negatively priced.

|

Negative pricing occurs even

in regions that are seeing large curtailment rates. In fact,

throughout ERCOT, it is virtually impossible to see a day go

by without several hours of negative pricing, even though ERCOT

mandates curtailing and the ISO oversees more wind curtailment

than any other region in America.

As expected, most of the periods

of lowest-priced energy fall within periods of higher wind power

generation. As will be explained more fully in the section “Wind

Curtailment” below, the instance of negative pricing is

quite sensitive to the price of natural gas – with periods

of higher cost natural gas resulting in more negative pricing

and curtailment, and periods of lower cost natural gas resulting

in fewer cases of both of the above.

Figure 3 illustrates

the number of hours per quarter that energy has been traded at

very low prices (<$10/MWh)

and the number of hours per quarter that energy has been

traded at negative pricing.

The reduction in low and negatively priced energy seen between

2009 and 2010 was a direct result of the fact that the amount

of energy curtailed in this region nearly tripled in that time

frame.

The modest stability that occurred throughout 2011 reflected

a balance between dropping natural gas prices and increasing

wind

power penetration.

Figure

3: The red columns show the number of hours

energy prices averaged below $0/MWh throughout the

Minnesota hub, the blue columns show the number of

hours energy traded below $10/MWh.

|

As more wind power is installed, more locales will have excess

energy more often that they have to sell, increasing the supply

in the open market. This serves to increase both the instance of

negative energy prices and the amount of wind curtailment.

Wind Curtailment.

An oft-heard criticism of wind farms is that people “drive

by them every day while the wind is blowing and the turbines aren’t

spinning”. This is true, and it’s often deliberate.

The turbine blades are often pitched so that they recover less

energy or no energy from the wind, a process commonly referred

to as “wind curtailment”. The reason is obvious:

if overproduction of wind power results in negative or ultra-low

priced

energy, one way to avoid paying to get rid of excess energy is

shutting down the energy production. So curtailment happens either

to prevent or eliminate negative pricing.

When the amount of energy coming online is greater than the energy

demand, the power provider must determine whether to reduce wind-energy

generation, or ramp down fossil power (it takes 5-10 minutes to

tamp down an NG peaker, 15-20 minutes to tamp down a combined cycle

gas turbine (CCGT), and hours to tamp down a coal plant). If fossil

power is chosen to be tamped back, the price of energy will likely

stay negative as long as that process takes.

If the power company backs off too far on a coal plant in the evening,

and then the wind suddenly drops, the power company will lose money

buying emergency excess power from neighboring markets and pushing

their natural gas peaking plants to max, all while inefficiently

re-firing their coal plants. The money lost due to such a miscalculation

could easily exceed what it would cost the power company to just

keep the baseload plants burning and curtail some of the wind when

the wind blows strongly. So the power companies use the best weather

predictions available (which are very accurate for a time horizon

of a few hours,) and make the best choices they can for maximizing

profit.

The more wind power penetrates within a given regional grid,

the greater this problem becomes, and the greater the instance

of curtailment.

Clearly, if natural gas is used as the “balance power”,

one of the key economic factors becomes the price of natural gas

itself. When natural gas prices are low, then the economic penalty

of shifting more power from baseload to natural gas is reduced.

Baseload is reduced to a greater extent when higher winds are forecast – leading

to less curtailment. When NG prices are high, then there is a

greater economic penalty for using the balance power, and there

would be

more instances where the power company will curtail the wind

power instead of reducing baseload power.

This is very complex, but in order to offer a visual illustration

of these impacts we’ll look specifically at Iowa – a

plains state with no hydropower capacity that sits at the convergence

of the three largest RTO’s in the U.S.: MISO, PJM, and SPP;

so there’s no question of transmission capacity here.

The following graph shows the total amount of wind energy curtailed

in Iowa in GWh (red columns), the percentage of Iowa’s

generation that was derived from wind (green area), and the price

of natural

gas in $/MMBTU (black line).

Note that even at NG prices of below $2.00/MMBTU

Iowa is still curtailing more than 10 GWh/month. When gas prices

were $4/MMBTU,

there was 169 GWh of curtailed wind energy because the wind power

penetration increased from 14.4% to 17.4%. Currently ~25% of

the state’s energy is derived from wind. An increase in

natural gas prices should result in far higher curtailment then

was seen previously at $4.00/MMBTU, as the wind power percentage

of total generation has increased dramatically.

WindFuels would end curtailments.

We expect that a major power provider would have a strong incentive

to contract with a WindFuels plant. In cases where excess wind

production begins to threaten grid stability, rather than curtailing

the wind they could merely direct excess energy to the electrolyzers

at a nearby WindFuels facility. This energy would be contracted

for a very low price, as the alternative would be curtailment – which

has zero value – or actually see the market price go negative.

In return, the power company could get SOME return on those hours

of wind power rather than none or negative, and they would also

be eligible to receive credit for renewable energy generation being

delivered to the grid – whether that would serve to satisfy

mandates or offer subsidies or tax credits.

There is a beautiful synergy here. If natural gas is cheap, a CARMA

plant would derive most of its feedstock from natural gas, while

purchasing some grid energy when the power company would otherwise

curtail their winds. If natural gas starts increasing in price,

the amount of extremely low cost grid energy will increase non-linearly

and the CARMA plant can use more cheap grid energy and less NG.

The other advantage for the power company is that there is now

the potential for a more stable grid at large, with the power company

having the ability to adjust the demand from electrolyzers from

2% to 100% or anywhere in between with <100 millisecond (ms)

warning. This would enable them to efficiently plan for operations

and run all of their baseload thermal systems at maximum efficiency

and effectiveness, while smoothing the way for much greater wind

penetration at maintained stability.

There is clearly a strong incentive for power providers to offer

very low energy pricing for WindFuels whenever RT prices are very

low, and there is enough curtailed wind energy NOW (even with very

low-priced natural gas) to provide for the needs of scores of WindFuels

plants throughout the Midwest.

Climate Benefit Note: if a new WindFuels plant is brought online

within a region and consumes 100 GWh from the grid with specific

timing so that there is 100 GWh less wind curtailment, then no

additional fossil energy would be used to provide that portion

of energy consumed by the WindFuels plant. The actual impact will

be greater than this, as a more stable grid requiring less curtailment

would encourage more development of wind within a grid – allowing

more fossil energy to be abated than could ever have occurred without

WindFuels plants being present.

Wasted Electrical Energy.

Keep in mind that during these times of high winds and excess power,

power companies are losing money hand over fist. Baseload power

costs money, and power companies have to pay the ISOs in order

to trade energy, which they are often trading at negative value.

When energy is traded over the ISOs at such times, it is often “purchased” by

neighboring municipalities, who now have excess power that they

must “sell” at a slightly higher price to their neighbors… in

effect a series of fees paid to the ISO to “push” the

energy to outlying regions that are not suffering from an energy

glut. The transmission may be through lines and transformers that

are near capacity, thereby imposing additional costs on the trading.

But other means of dealing with excess energy abound. It’s

fairly easy to imagine that every light in every facility owned

by a power company will be shining brightly before excess power

gets “sold” for a negative price. The same is undoubtedly

true with excess AC/climate control, water heating, and whatever

else can be done with the energy, including simply running large

amounts of energy through resistor banks and heating the parking

lots.

If the energy is being “sold” at negative pricing,

it’s equally easy to imagine the co-ops who “purchase” this

energy would also be motivated to use this energy even if they

don’t have sufficient demand within their customer base,

and they too would use lighting, heating, air conditioning, and

any other power draw they could find to utilize or waste this electricity

in the middle of the night.

This is why it is not uncommon to see areas that boast of “green” initiatives

end up having tremendous amounts of lights burning in every city

building through the night, or large outdoor heating vents operating

at odd times throughout the night.

There is no way to determine exactly how much electricity is wasted,

but there is a certain financial motivation, and compelling anecdotal

evidence throughout the wind corridor.

As wind power continues to build out and develop a deeper penetration

into regional grid portfolios, all three of these issues that are

currently costing power companies – curtailment, negative

energy pricing, and electricity wasting – will continue to

increase. A low-cost contract for variable power demand during

excess generation periods would be far more profitable for the

power companies in all cases. We expect there will be no difficulty

getting favorable contracts for at least the next several decades.

Won’t

they simply stop building wind farms?

The immediate reaction from most investors

after they learn about some of the difficulties facing

high wind

penetration

into the grid is: clearly this cannot last! They’ll

stop building wind power until some “fix” is

found. The DOE apparently agrees with this assessment.

However, the DOE’s record of projecting renewable

energy installations may be even worse than their record

on projecting oil prices, and they have had a history of

being irrationally bearish on wind in particular, as we’ll

show...

Even as recently as early 2008, the DOE’s “high

economic growth case” in their Annual Energy Outlook

(AEO) 2008 was projecting a total wind capacity of 27.3

GW by 2010 and 34.6 GW by 2020. According to AEO 2008 we

would see 94 TWh generated in 2019.

The projections for wind energy generation according to

the AEO 2011 are shown in Table 1. The boldfaced years

represent actual data, the remaining are projections calculated

from the 4th quarter of 2010.

The actual data from 2010 shows that the year ended with

wind generation totaling 94.6 TWh. At the end of the second

quarter of 2012, the total installed capacity across America

was 50 GW, a milestone that the DOE stated just 16 months

earlier would not be reached for another 11 years.

While the prediction of a complete cessation of any new

installations in wind power may seem shocking, the DOE

has been predicting just such an event for years. Each

year with the new release of the AEO, they merely advance

the year in which all wind growth stops. The DOE’s

2012 AEO has remained true to form, projecting 53 GW of

installed wind power by the end of 2012, and 54 GW of installed

wind power by the end of 2020. There’s currently

another 10 GW of wind power under construction in the U.S.,

which will certainly be completed within the next 16 months.

It seems obvious that this kind of projection is more a

reflection of bias at the DOE rather than a serious attempt

to project the growth of wind. This may seem to be picking

on the DOE excessively, but it is important to realize

that they have historically been further afield in their

projections for renewable energy than any other analysts,

including coal and natural gas lobbies.

|

Year |

Average

Installed Capacity |

Total

Generation |

| 2008 |

24.89 |

55.42 |

| 2009 |

31.45 |

70.82 |

2010 |

37.49 |

91.25 |

2011 |

41.62 |

109.31 |

2012 |

48.9 |

141.78 |

2013 |

48.9 |

141.77 |

2014 |

48.9 |

141.77 |

2015 |

48.9 |

141.77 |

2016 |

48.9 |

141.77 |

2017 |

48.9 |

141.78 |

2018 |

48.9 |

141.78 |

2019 |

48.9 |

141.78 |

2020 |

49.01 |

142.16 |

2021 |

49.01 |

142.16 |

2022 |

49.64 |

144.32 |

2023 |

50.3 |

146.6 |

2024 |

50.78 |

148.46 |

2025 |

51.56 |

150.73 |

Table

1: Unreasonably pessimistic projections

from the DOE AEO 2011

for wind development in the U.S.

|

You

still haven’t explained why they won’t just stop

building wind farms.

It boils down to government intervention. Thirty-eight states

have renewable portfolio standards (RPSs, sometimes called

RESs, renewable electricity standards). For these states, the

power companies are mandated to utilize more renewable energy,

whether there is a cost justification in doing so or not. This

has been the dominant driving force behind both the wind and

solar industries for the past decade, and more states are either

adopting or expanding RPSs every year. After the record-shattering

heat wave/drought of 2012, it’s likely that resistance

to measures reducing carbon emissions should decrease throughout

the wind belt, and even more aggressive RPS legislation may

come into play.

Table 2 was compiled (mid-2012) to help give a better appreciation

for how much renewable energy must be brought online in the

coming years – in order to comply with government mandates.

Some RPSs specify installed capacity rather than percentage

of energy produced. Many specify minimum portions for certain

industries, and in some cases a date is specified so that only

newer installations can count towards this mandate.

State |

|

|

Specified non-wind |

Unspecified renewable energy needed

to fulfill RPS assuming 0.8% annual growth |

Mandated year of compliance |

Amount

of new renewable energy needed/year |

|

(GWh) |

% |

% |

(GWh) |

|

(GWh) |

AZ |

74,612 |

15.0% |

4.5% |

8,234 |

2025 |

588.2 |

CA |

251,336 |

33.0% |

|

16,238 |

2020 |

1,804.2 |

CO |

53,299 |

30.0% |

3.0% |

8,359 |

2020 |

928.7 |

CT |

29,911 |

27.0% |

7.0% |

5,655 |

2020 |

628.4 |

DC |

11,562 |

20.0% |

2.5% |

2,169 |

2020 |

241.0 |

DE |

11,522 |

25.0% |

3.5% |

2,610 |

2025 |

186.4 |

HI |

9,961 |

40.0% |

|

3,689 |

2030 |

194.1 |

IA |

56,938 |

105 MW |

|

Satisfied |

Satisfied |

|

IL |

141,954 |

25.0% |

7.0% |

21,293 |

2025 |

1,521.0 |

IN |

104,721 |

10.0% |

|

5,113 |

2025 |

365.2 |

KS |

45,565 |

20% Peak Capacity |

|

|

|

|

MA |

55,070 |

22.1% |

7.1% |

7,528 |

2020 |

836.5 |

MD |

65,581 |

22.0% |

2.0% |

13,207 |

2022 |

1,200.6 |

ME |

11,411 |

40.0% |

30.0% |

483 |

2017 |

80.4 |

MI |

104,632 |

10.0% |

|

5,466 |

2015 |

1,366.4 |

MN |

67,904 |

25.0% |

|

12,051 |

2025 |

860.8 |

MO |

83,837 |

15.0% |

0.3% |

10,832 |

2021 |

1,083.2 |

MT |

13,796 |

15.0% |

|

890 |

2015 |

222.4 |

NC |

131,879 |

12.5% |

1.2% |

13,979 |

2021 |

1,397.9 |

ND |

13,710 |

10.0% |

|

Satisfied |

Satisfied |

|

NH |

10,864 |

24.8% |

9.8% |

543 |

2025 |

38.8 |

NJ |

76,759 |

24.5% |

6.6% |

13,117 |

2020 |

1,457.4 |

NM |

22,987 |

20.0% |

6.6% |

1,100 |

2020 |

122.2 |

NV |

33,887 |

25.0% |

1.5% |

5,892 |

2025 |

420.9 |

NY |

143,663 |

30.0% |

21.7% |

6,460 |

2015 |

1,615.0 |

OH |

154,111 |

12.5% |

0.5% |

19,402 |

2025 |

1,385.9 |

OK |

59,418 |

15.0% |

|

1,471 |

2015 |

367.6 |

OR |

47,131 |

25.0% |

|

7,418 |

2025 |

529.9 |

PA |

148,840 |

18.0% |

10.5% |

8,254 |

2021 |

825.4 |

RI |

7,710 |

16.0% |

|

1,166 |

2019 |

145.7 |

SD |

11,542 |

10.0% |

|

Satisfied |

2015 |

|

TX |

364,505 |

10,000 MW |

|

Satisfied |

Satisfied |

|

UT |

28,867 |

20.0% |

|

5,305 |

2025 |

378.9 |

VA |

111,580 |

15.0% |

|

14,770 |

2025 |

1,055.0 |

VT |

5,537 |

20.0% |

|

694 |

2017 |

115.6 |

WA |

93,075 |

15.0% |

|

6,533 |

2020 |

725.9 |

WI |

68,695 |

10.0% |

|

4,478 |

2015 |

1,119.6 |

WV |

31,264 |

25.0% |

2.5% |

5,212 |

2025 |

372.3 |

Total |

2,759,636 |

|

|

|

|

|

|

Table

2: The passed state RPS mandates and goals as of mid-2012,

and the portion of those mandates that may be satisfied

by wind. |

Because of this, a state like Washington – which

derives over 60% of its energy from renewable sources – still

is not achieving its 15% RPS mandate. In all cases, while compiling

Table 2, we were careful to only factor in the portion of RPS

mandates that could be fulfilled by wind energy.

Effort went into accounting for the amount of currently installed

renewable energy that counted towards the RPS, and energy that

did not count towards the RPS was not considered. In order

to adhere to all regulations and goals that are currently on

the books, the U.S. will have to average an additional 24.2

TWh of renewable energy/year.

Between 2000 and 2010, America saw a total electricity demand

increase of 8.4%, and that time frame oversaw a very sluggish

economic growth that both began and ended with recessions.

The fifth column in Table 2 shows what must be implemented

if demand growth in the next decade merely equals that of the

previous one.

Even based on this conservative growth assumption, just to

satisfy current RES mandates 24.2 TWh of additional renewable

energy will have to be generated from new sources EVERY YEAR – not

counting the solar, hydro, distributed generation, farm waste,

and other itemized sources within these state mandates.

A quick look at the previous two decades should help us understand

the potential growth of many of these renewable options. Table

3 was compiled to demonstrate the growth and/or contraction

of the most popular renewable energy technologies.

Table

3:

Electrical

energy (TWh/yr) generated from renewable resources

in the U.S. |

Year |

Hydropower |

Wind |

Solar |

Geothermal |

Total Biomass |

1993 |

280.5 |

3.0 |

0.5 |

16.8 |

56.0 |

.... |

|

|

|

|

|

1997 |

356.5 |

3.3

|

0.5 |

14.7 |

58.7 |

... |

|

|

|

|

|

2000 |

275.6 |

5.6 |

0.5 |

14.1 |

60.7 |

2002 |

264.3 |

10.4 |

0.6 |

14.5 |

53.7 |

2004 |

268.4 |

14.1 |

0.6 |

14.8 |

53.5 |

2006 |

289.2 |

26.6 |

0.5 |

14.6 |

54.9 |

2007 |

247.5 |

34.4 |

0.6 |

14.6 |

55.5 |

2008 |

254.8 |

55.4 |

0.9 |

14.8 |

55.0 |

2009 |

273.4 |

73.9 |

0.9 |

15.0 |

54.5 |

2010

|

257.1

|

94.6

|

1.3

|

15.7

|

56.5

|

2011 |

325.1 |

119.7 |

1.8 |

16.7 |

56.7 |

Change 2000-2011

|

+49.5

(+18.0%)

|

+114.1

(+2038%)

|

+1.3

(+260%)

|

+2.6

(+18.4%)

|

-4.0

(-6.6%)

|

| |

|

|

|

|

|

January-May

|

Hydropower

|

Wind

|

Solar

|

Geothermal

|

Total Biomass

|

2011 |

147.3 |

53.8 |

0.6 |

7.0 |

22.7 |

2012 |

126.8 |

63.5 |

1.2 |

7.0 |

25.7 |

Hydropower in America peaked in 1997

at 356.5 TWh. Weather variation shows as much as a 68 TWh

variation in yield for any given year, but the average yield

over the last 11 years has been 267.5 TWh – nearly

90 TWh below the 1997 peak. Water demand for irrigation and

consumption have decreased the volume of water passing through

the dams, and more dams have been decommissioned and destroyed

than built in the last decade. These trends are likely to

continue in the U.S., and 2020 seems likely to see less energy

from hydropower than what was averaged over the last decade.

Solar power has only recently seen build rates that outpaced

the degradation of earlier panels, and it is still insignificant.

Most solar development in the U.S. over the next decade will

be built to comply with technology-specific line items within

state’s RES mandates, and this additional generation

will be counted towards those mandates, not the generation

requirements calculated here.

Geothermal power peaked in 1993, but there has been recent

activity suggesting that this will be a growth technology for

a while. Growth over the last year has accelerated to a rate

of 6% annual growth. If this accelerated rate continues, then

a total of 11-12 additional TWh compared to that seen in 2010

can be expected by 2020.

Biomass-sourced electricity peaked in 2000 at 60.7 TWh. Though

wood co-firing has remained consistent, other sources of biomass

have receded due to competition from biofuels. Biomass has

averaged 54 TWh/year over the past decade.

It should be noted that considering only these most often discussed

sources of renewable energy – hydropower, solar, wind,

geothermal, and biomass – more renewable electricity

was generated in 1997 than in 2010. The only renewable energy

technology that saw significant growth within the last decade

is wind power – growing at an average of 32%/yr in the

U.S for the past 11 years. Wind will certainly comprise a super-majority

of the renewable energy that is brought online to meet the

additional 24.2 TWh/yr currently mandated.

Therefore, if we were to assume that wind comprised all but

~20 TWh/year of the mandated energy generation over the next

decade, there would still need to be at least 7 GW/yr installed

across America in order to achieve compliance. More aggressive

RPS mandates may be coming as the reality of global warming

sets in.

The wind farms are coming, whether or not the power companies

have any viable integration solutions.

The

high cost of “peaker” energy.

“ Peak energy” is

costly because power companies are often forced to build “peaker” natural

gas power plants to service only a few hours of the day.

This means that these new plants will only operate between

4-25% capacity factor. Rules from the North American Electric

Reliability Corporation (NERC) require that a minimum capacity

of reserve be built out to insure that summer peak demands

can be reliably met. This is essential, as it reduces the

likelihood of roaming blackouts in the summer, but it is

also costly. Invariably, the power companies will make

these plants as cheaply as possible and they (1) consistently

have high NOX emissions, (2) often exceed SO2 and other

harmful emissions of baseload plants even though they usually

are gas-burning, and (3) have low efficiencies. In some

cases, there are still diesel generators serving as peakers. |

NERC Region |

Discount

rate for wind |

MRO |

8.0% |

SPP |

8.2% |

ERCOT |

8.7% |

SERC |

9.9% |

NPCC |

13.2% |

RFC |

16.6% |

WECC |

18.5% |

Table 4: the discount rate applied

to

wind capacity for minimum

reserve capacity compliance. |

Increased

wind penetration is changing the game here as well. Power companies “discount” the

capacity of wind when it comes to calculations for minimum

compliance levels. The extent to which wind is discounted varies

per NERC region, but they all fall between 8 and 18.5%, and

they typically drop as wind energy penetrates more deeply within

the region. What this means, is that if a 100 MW wind farm

is brought online in Nebraska (part of the MRO region), then

power companies only get credit for 8 MW of new capacity in

the region, and they must keep their fossil plants on standby

to comply with minimum reserve capacity requirements. The typical

capacity factor for new wind farms (before curtailment) is

32-35%, so clearly having only an 8% credit will result in

having too much capacity most of the time.

This is eliminating the need for new peaker plants in any region

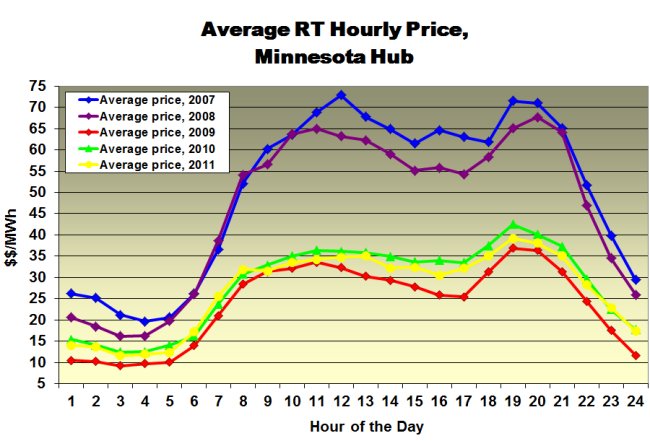

that has deep wind penetration, and as shown in Figure

5, the

effect on grid energy prices is little short of shocking. As

is the case with most of the rest of the price data, the impact

on prices was tempered by increased curtailment.

Within MISO, more than 50% of wind curtailment occurs during

peak hours. Using wind curtailment has supplanted using

rapidly ramping/tamping peaker plants to balance hour-by-hour

supply

and demand loads. In some cases it is less expensive to

over-build wind and curtail it than it is to use a

gas peaker.

The Un-viability of Conventional Energy Storage.

What increasing wind penetration has done is render

traditional energy storage completely unviable in those regions.

Referring

to Figure 5 tells part of the story; in 2007-2008, power

companies and co-ops bought and sold energy to one another

at prices averaging $60.24/MWh, during peak hours and prices

averaging $24.12/MWh during off-peak hours, a difference

of $36.12/MWh. After the market became saturated with wind,

peak-hour prices for all of 2009-2011 averaged only $32.52/MWh,

and off-peak hours averaged only $14.10/MWh, for a difference

of only $18.42/MWh. That’s a $17.70/MWh average loss

in potential revenue if the technology’s business model

is to sell energy back to the grid during the “high

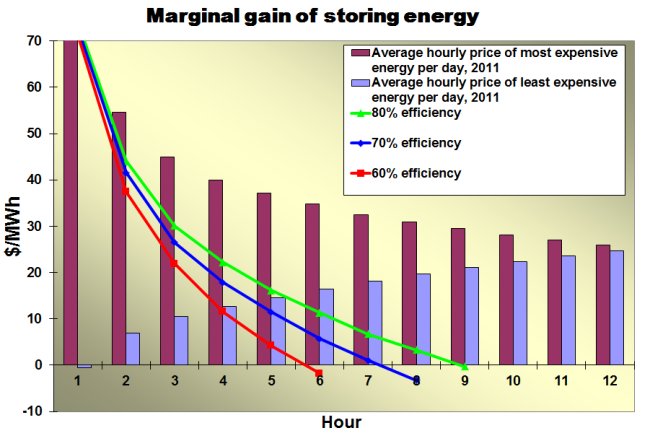

priced” peak hours. Figure 6 brings this point home

even more bluntly by displaying the average of the highest

and lowest hours of each day and then tracing the average

marginal profit of a hypothetical energy storage system which

bought energy at the lowest possible price and managed with

perfect timing to sell that energy back to the grid at precisely

the highest possible price (which could not happen).

As seen from this data, purchasing grid energy and then selling

it back during peak hours (again assuming perfect timing) does

not allow much profit potential. This information should be

especially troubling for those hoping that conventional energy

storage will play a major role in integration and stability

for increased wind penetration. We have investigated the cost

of grid-level energy storage (our ASME ES2010 energy storage

paper is available here). The findings of our work have proven

to be more discerning than the traditional rhetoric that is

found elsewhere. Reviewing the LMP pricing data, a clear pattern

emerges that holds even as the overall price shifts radically

from year to year. During the warmer periods (second and third

quarters), there is a single trough in pricing, and the price

gradually increases to a single peak and then gradually descends.

During the cold periods (the first and fourth quarters of each

year), there are two peaks and two troughs. Hence, an energy

storage option that would take electrical energy from the grid

during low-price hours and sell that energy back during high-priced

hours would only cycle once per day during warm months and

twice per day during colder months. This changes the levelized

cost of energy storage considerably. For more details, the

interested reader is referred to our ASME ES2010 paper.

For WindFuels, the cost of delivered energy is similar to that

for pumped hydrostorage, but unlike all of the other options,

the stored energy will not be sold back into the local grid.

The storage for gasoline, diesel, jet fuel, and other liquid

fuels is inexpensive enough that the products can be stored

(perhaps 5-8 months) until the front-month contract is ideal

to sell. Conventional energy storage, on the other hand, must

sell the energy back into the grid, and the storage cost is

far too high to hold it for more than half a day.

Gasoline sold for ~$3.50/gallon during 2011, which works out

to ~$100/MWh. While we fully expect the price of oil and petro-products

to increase steadily over the next 5 years, the price is currently

sufficiently high to illustrate the advantage of liquid fuels

energy storage. (We expect that by 2015 the market price for

transportation fuels will be at least $150/MWh.)

Conclusions.

We have shown that, absent Windfuels, mandated RES policies

will lead to increased curtailment, increased availability

of negative-priced electricity, and reduced opportunities for

conventional energy-storage technologies to operate profitably.

These trends are expected to continue for at least several

decades, and these trends, along with the steadily increasing

price of liquid transportation fuels, establish an undeniably

strong economic and climate-benefit argument for synthesizing

standard fuels from clean, off-peak wind energy and CO2.

References:

X Lu, MB McElroy, and J Kiviluoma, “Global

potential for wind-generated electricity”, PNAS, 10.1073,

2009.

ED Delarue, PJ Luickx, and WD D’haeseleer, “The

actual effect of wind power on overall electricity generation

costs and CO2 emissions”, Energy Conv. and Mngmt 50,

1450-1456, 2009.

http://www.eia.doe.gov/ceaf/electricity/epm/table5_6_b.html

http://navigator.awstruewind.com/

MISO, https://www.midwestiso.org/Library/MarketReports/Pages/MarketReports.aspx

http://www.greentechmedia.com/articles/texas-wind-farms-bring-free-energy-and-cash-bonuses--5347.html

http://www.awea.org/faq/wwt_costs.html

http://www.thefreelibrary.com/A+novel+PSO+algorithm+for+optimal+production+cost+of+the+power...-a0216183027

http://ucsusa.org/clean_energy/solutions/big_picture_solutions/production-tax-credit-for.html

http://www.renewableenergyworld.com/rea/magazine/story?id=53498

http://dsireusa.org/

http://www.eia.doe.gov/cneaf/electricity/epa/generation_state_mon.xls

http://www.eia.doe.gov/todayinenergy/detail.cfm?id=1370

http://www.eia.doe.gov/cneaf/electricity/page/sales_revenue.xls

|

|

| |

RTO's and ISO's control

a large percentage of the electricity sold in America.

The largest RTO/ISO's include:

PJM serves

portions or all of DE, IL, IN, KY, MD, MI, NJ, NC, OH,

PA, TN, VA, WV, and DC.

MISO serves

portions or all of IA, IL, IN, MI, MN, MO, MT, NE, ND,

OH, SD, and WI.

CAISO serves

the state of California.

ERCOT serves

most of the state of Texas.

SPP serves

portions or all of AK, KS, LA, MO, NE, NM, OK, and TX

(most of the panhandle).

NYISO serves

the state of New York.

ISONE serves

all of CT, MA, ME, NH, RI, and VT.

|

| |

Unlike water and gas, which are fed from huge reservoirs,

electricity must always flow. It cannot remain unused

within the power lines. Electricity must instantaneously

be used or it may damage assets connected to the grid.

Whenever generation exceeds demand the excess must be

dissipated, even at a cost.

Power companies may avoid this by curtailing wind energy,

or they may sell the energy at a significant loss.

|

|

| |

|

| |

Many nights the lights in the Midwest actually are

brighter than those seen in the Northeast or West Coast

- dispite the enormous difference in population density

and wealth.

photo courtesy of NASA

|

| |

|

The wind resource map shown

here - courtesy of NREL - displays the available wind resource

at 80 m. Modern wind turbines hubs are now over 100 m, so

the available resource is far greater than that shown here.

|

| |

|

| |

|

Hydropower

can be a mixed blessing for power companies attempting

to deal with wind integration. Weather variation can

be quite extreme. The spring of 2011 saw record high river

levels. The Bonneville Power

Administration

(BPA) made a controversial decision to respond to this

unusually high generation by breaking their PPA contracts

and shutting down the local wind farms.

(This resulted in lawsuits.)

|

| |

|

| |

| |

|

| |

|

Pumped

hydrostorage is the grid-to-grid option that has the best

overall economic merit (though it would still show a net

loss trading in ISO's with high wind penetration).

However, most of the Midwest that is having difficulty

with grid saturation is not well suited for pumped hydrostorage.

Pumped hydro needs a very significant elevation change.

|

|

|

|